December Jobs Report – Mixed at Best

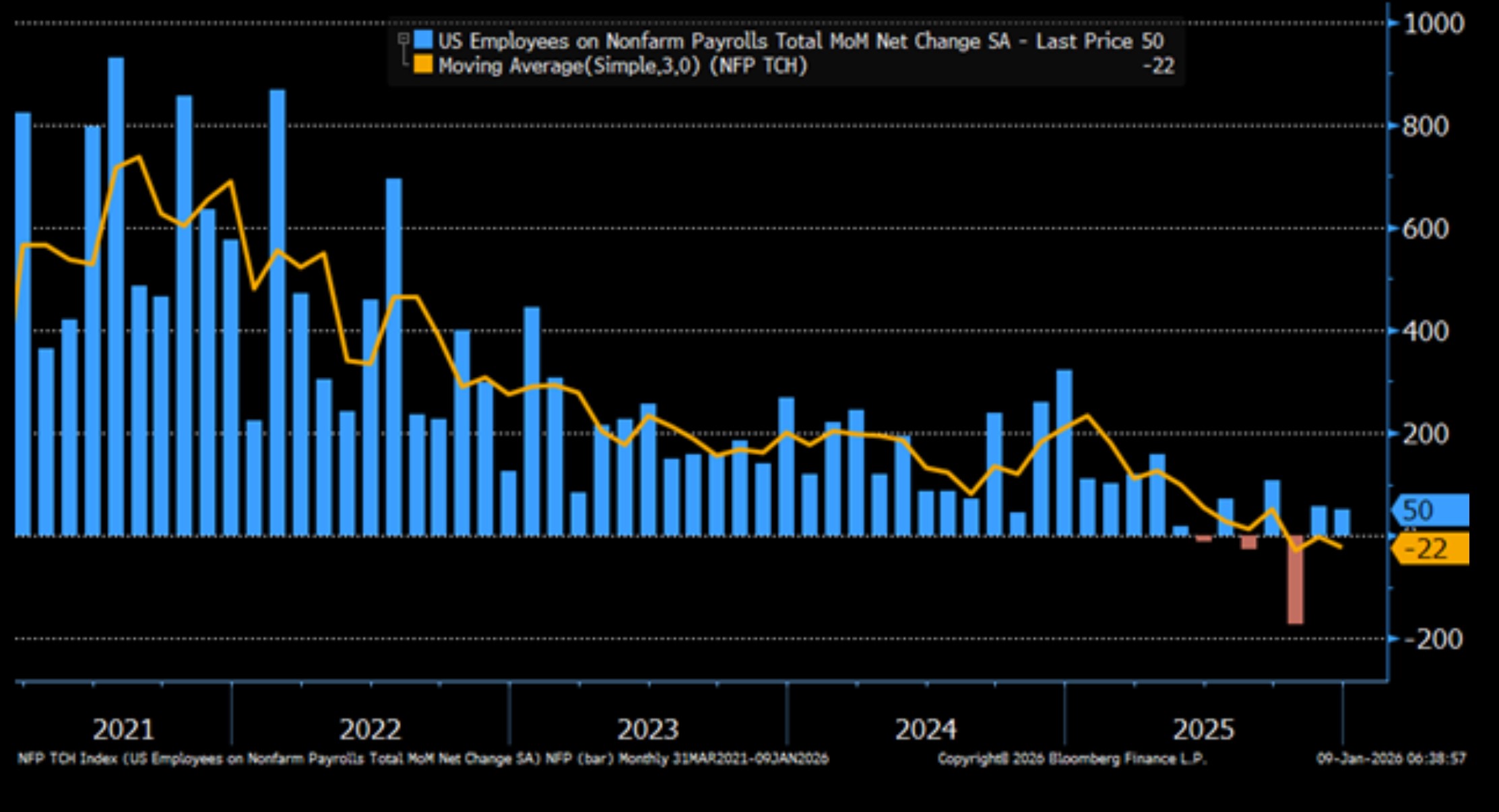

- December nonfarm payrolls rose 50 thousand, missing the 70 thousand expected and 56 thousand gained in November (revised lower from an initial 64 thousand). Two-month revisions cut 76 thousand jobs from previous estimates with October revised 68 thousand lower and November 8 thousand jobs lower. Private sector job growth was 37 thousand which was half the 75 thousand expected and 50 thousand increase in November. With Fed Chair Powell estimating BLS is overstating hiring by around 60 thousand per month, the latest job growth number fails to keep us above water if downward revisions come as expected.

- Speaking of revisions, they have been to the downside for well over a year, with most of the blame placed on low initial survey response rates from companies. They have three months to respond but the initial job estimate has been plagued by low responses that belatedly arrive, thus contributing to the large revisions. Also, the large October revision no doubt was impacted by government layoffs that were announced earlier in the year but delayed until the new fiscal year that began in October. Also contributing to revisions, the BLS’s birth/death model of new business creation/demise has consistently overstated net business formation since the pandemic. The BLS is working to adjust this model, but it’s a work-in-progress and has been a big piece of the downward adjustment trend. In any event, post revisions, the average monthly change over the last three months was a net loss of 22 thousand overall and a net gain of 29 thousand in the private sector.

- The Household Survey, which is smaller than the Establishment Survey generates the unemployment rate, labor force participation rate, etc.. The survey reported a decrease of 46 thousand people in the labor force (those employed and those not working but actively looking for employment) and a 278 thousand decrease in unemployed persons. The unemployment rate decreased two-tenths to 4.4% (4.375% unrounded vs. 4.536% in November). So, just a 16bps change between months but due to rounding it looks a bit more positive than it probably should.

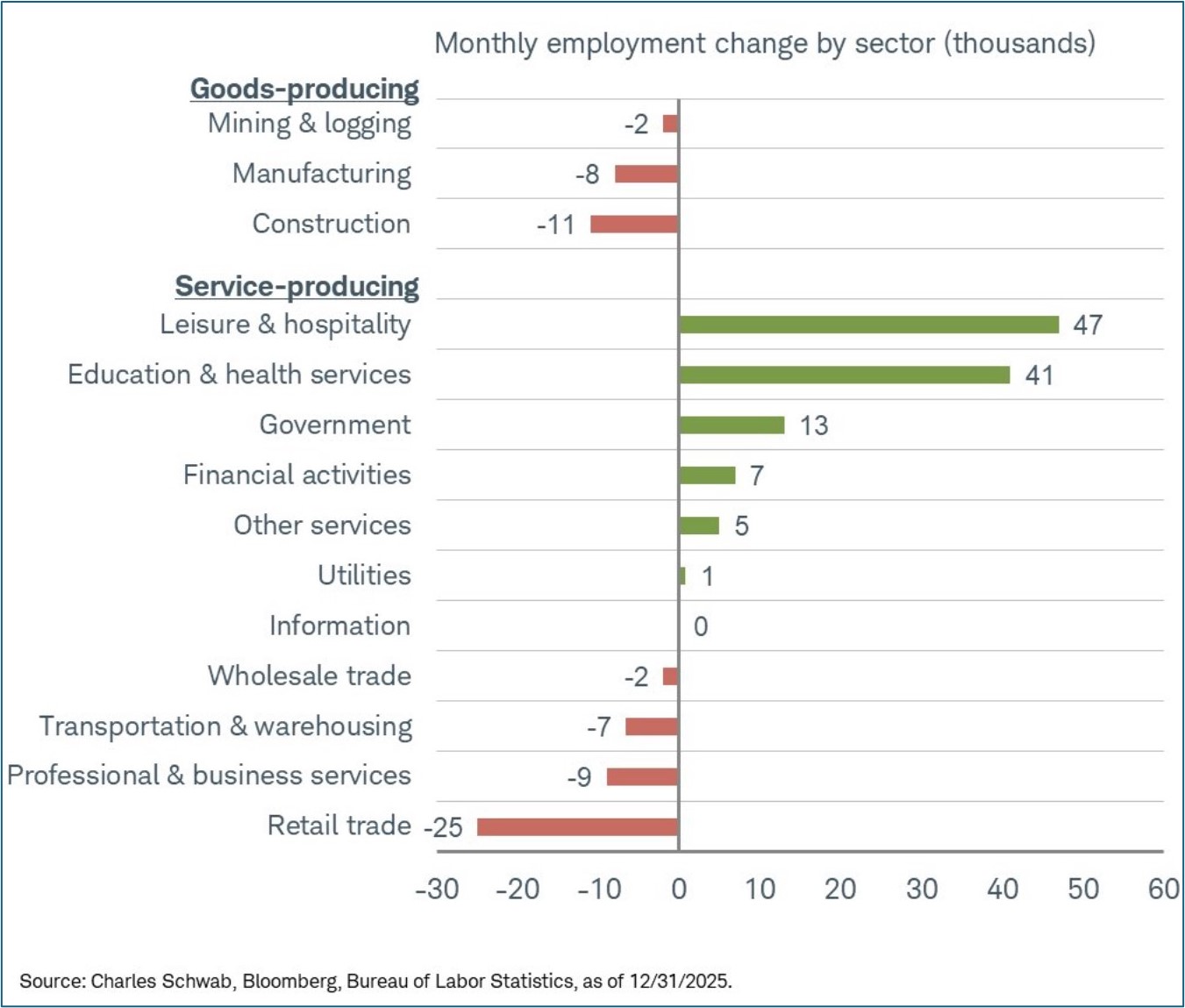

- Job gains were strong once again in healthcare/social assistance, a perennially strong category, (38k). Other categories showing gains were leisure and hospitality which surged 47 thousand jobs, and government (mostly state) gained 13 thousand jobs. It’s curious to see leisure/hospitality strongly adding jobs but it could be seasonal factors with holiday staffing at play. I suspect we’ll see some give back in this sector in the coming months. Job losses were concentrated in durable goods manufacturing (-21k), and retail trade (-25k) (see chart below).

- With the small decrease in the labor force, the Labor Force Participation Rate decreased a tenth to 62.4%, matching expectations. Another metric of labor utilization that uses a wider lens is the employment-to-population ratio and that is shrinking as well, albeit slowly. It was 59.9% a year ago and sits at 59.7% vs. 59.6% in November. That annual slippage in both participation rates, while slight, is not what the Fed wants to see.

- Average Hourly Earnings rose 0.3% MoM, matching expectations and beating November’s 0.1% gain. The year-over-year pace ticked higher to 3.8% beating the 3.6% expectation and 3.6% in November. Average weekly hours worked, however, slipped a tenth to 34.2 hours. While that seems inconsequential, the combination of the wage gain of 0.3% and loss of hours worked results in average weekly earnings increasing just 41 cents, not exactly the boon like a subscription to the Jelly of the Month Club. Bottom line, with YoY wage gains moderating in the mid-3% range, wage-price inflation shouldn’t be a Fed worry; thus, removing one arrow from the inflation hawks quiver.

- The December jobs report continues a trend in the labor market of modest-at-best job gains. As shown in other reports, the service sector continues to carry the bulk of job gains (71K service jobs vs. -21K in goods), and the latest manufacturing reports show little near-term improvement. The good news is that the mid to upper income consumer continues to spend and that is keeping the heart beating on the services side of the economy. Bottom line: the hiring machine has slowed to a near standstill, with expected downward revisions, and labor force growth has slowed to a standstill as well. Those are not the ingredients for a robust economic expansion. This report is just positive enough to keep thoughts of a January cut only for the most ardent of Fed doves, but a first cut in 2026 is still most likely a March or April event.

Monthly Job Gains and 3-Month Average – The Trend is Clear

Service Side Jobs Continue to Lead the Way

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.