Fed vs. DOJ – What to Make of It

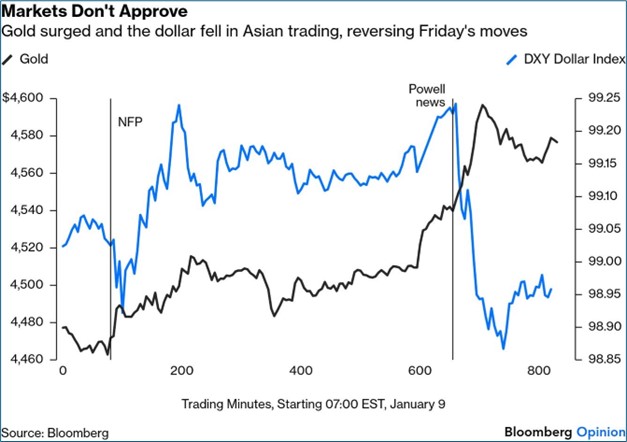

- This was supposed to be Inflation Week, but our regularly scheduled programming has been pre-empted by an assault against the Fed’s independence. In a remarkable video released yesterday (watch here), Chair Powell revealed the Fed had been served Grand Jury subpoenas on Friday, ostensibly over statements Powell made to Congress last June regarding the Federal Reserve’s building renovation project. As Powell states clearly, in his view, the real reason for the legal move is over the Fed’s reluctance to lower rates more quickly than they did. For now, the market action is measured but definitely negative with equities and the dollar lower, and gold and rates higher. Stay tuned for further developments. Currently, the 10yr is yielding 4.19%, up 2bps, while the 2yr is yielding 3.54%, unchanged on the day.

- Like Powell, we view this move as an overt threat to Fed independence, and a message to the next Fed chairman to expect to do the administration’s wishes regarding monetary policy. While the Fed is in the process of lowering rates on the short-end (albeit slower than the administration wishes), it has much less control over longer end yields, and investors anticipating a central bank that operates as directed by the White House will, if they invest at all, demand a higher risk premium for that lack of independence.

- Powell, at his core, is an institutionalist and he understands the principal of independence; thus, it no doubt prompted the video where he unambiguously states his opinion of the legal action. In the past, Powell always steered clear of attempts to have him opine on fiscal, or White House policy, so this video is unique in that regard. As Powell and market watchers know, history is littered with examples of central banks beholden to government leaders and the result is typically higher inflation – usually much higher – followed by higher rates and a struggling economy. For now, the market is reacting as expected but in a measured way as this all could be reversed in a Truth Social post this afternoon if the equity market swoons enough. Who knows? Ultimately, however, these bouts of volatility and uncertainty will undermine the economy and the investment appeal of the US, and that is most definitely not a good thing. The December jobs report revealed a labor market essentially stuck in neutral and increased uncertainty could cause it to slip into reverse.

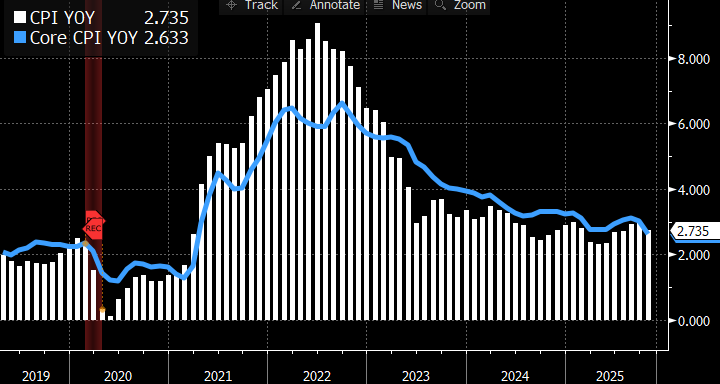

- Meanwhile, back to our regularly scheduled programming. Tomorrow, December CPI is expected to show overall inflation increased 0.3% for the month with the YoY rate unchanged at 2.7%. In November, the overall rate increased 0.2% covering October through November with the YoY rate at 2.7%. Meanwhile, core CPI is expected to also increase 0.3% MoM vs. 0.2% covering October and November with the YoY rate ticking up a tenth to 2.7%. The next few months will see 0.2% and 0.3% prints from last year roll off, so if core can print at 0.2% or less the YoY pace could move into the mid-2% range by mid-year. One reason for that optimism on inflation is that the largest component of CPI, Owners’ Equivalent Rent (OER), is definitely on the downslope as the weakened housing market is finally starting to show in this notoriously lagging series. If the lack of tariff passthrough continues, and core services continue to moderate, it should provide a decent setting to see some improvement in the yearly figures moving slowly towards the 2% target.

- On Wednesday, November PPI will be released with headline PPI Final Demand expected up 0.2% MoM with the YoY rate at 2.6%, a level it’s been flirting with since August. PPI ex-food and energy is also expected to increase 0.2%. The absence of data collection for October and the month-long delay in getting November PPI lessens the impact of the report. Nevertheless, many PPI components feed into the Fed’s preferred inflation gauge, the Personal Consumption Expenditures (PCE), so filling in some of the blanks will continue the process of filling in holes created from the government shutdown.

- Usually, when we had PPI and CPI in hand analysts would get busy with calculating core PCE (the Fed’s preferred measure). The last core PCE we have is September at 2.8% with the October and November figures expected next week (Jan. 22). The BEA has yet to publish a date for the December results, but the expectation is for late January, if the typical pattern holds, but we haven’t heard officially from the BEA on a date so it may very well slip.

- November retail sales will also be released on Wednesday with another solid month of spending expected from the US-based consumer. Advance Retail Sales are expected to increase 0.4%, as are sales ex-autos, while a more core view of sales, sales ex-autos and gas, is expected up 0.3%. The control group, a direct GDP feed, is expected to increase 0.4% which would be a solid boost to fourth quarter GDP.

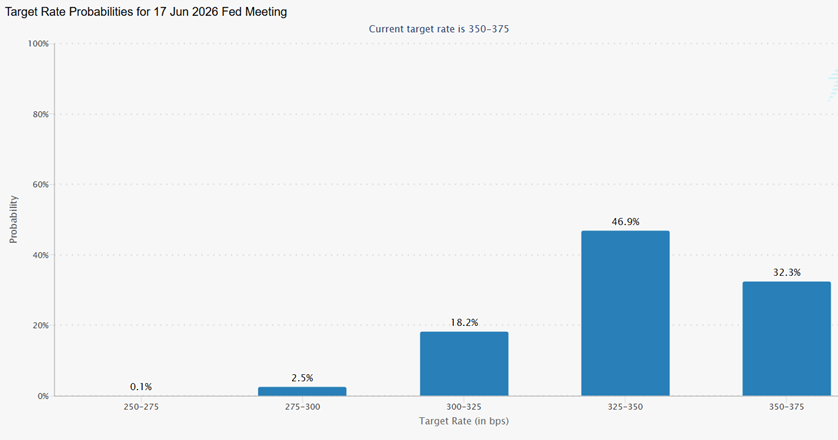

However, Market Still Sees First Rate Cut at June Meeting – Little Changed after Fed News

Source: CME Group

December CPI Expected to Remain Near 2.6 – 2.7% YoY

Source: BLS

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.