Much Anticipated Labor Market Data Starts to Arrive Today

- So far, the weekend events in Venezuela have failed to catalyze meaningful volatility, perhaps an indication that markets remain fixated on the state of the labor market to drive yields from here. To that extent, the rest of this week will begin to deliver some of the requisite data points that have either been missing or of questionable veracity since the government shutdown. Fortunately, ADP, JOLTS, ISM, and NFP are the reports that will fill in some missing pieces of the labor puzzle and potentially the fuel to drive yields out of their recent ranges. Currently, the 10yr Treasury is yielding 4.13%, down 5bps on the day, while the 2yr note yields 3.45%, down 2bps in early trading.

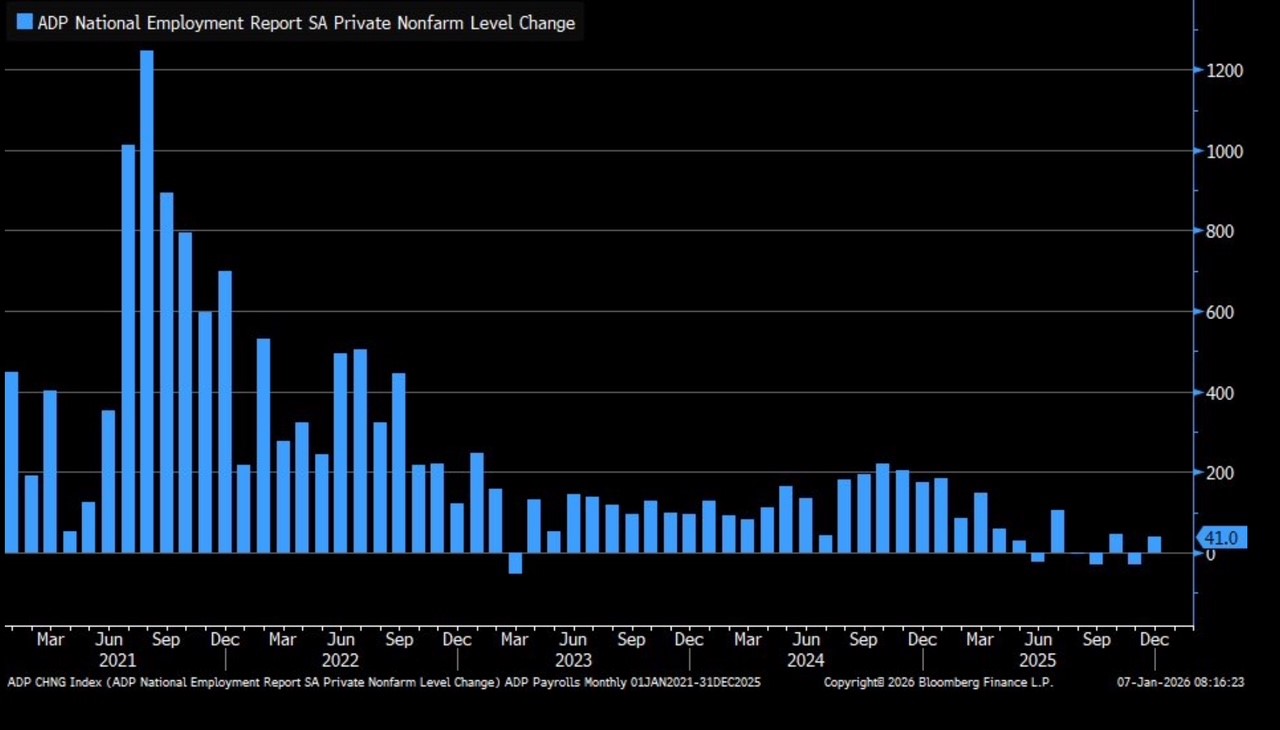

- We teased on Monday that this week would finally see some legit tier 1 level economic reports and that starts today with the ADP Employment Change Report for December. ADP reported this morning that 41 thousand private sector jobs were created in December compared to 50 thousand expected and a loss of 32 thousand jobs reported in November. In that month, job losses were concentrated in the smallest firms, less able to navigate the tariff uncertainties of 2025.

- Job creation in December was spread across firm size with the smallest firms (0- 50 employees) seeing gains of 9 thousand jobs but middle size firms (50 – 500 employees) did better creating 34 thousand jobs. Larger firms (> 500 employees) saw only 2 thousand new jobs. Sectors that gained jobs were in the less economically sensitive like education and health services, but leisure and hospitality also gained which indicates consumers are still spending their discretionary income. Meanwhile, annual wage gains for Job Stayers was unchanged at 4.40% Job Leavers saw annual wage increase from 6.30% to 6.60%.

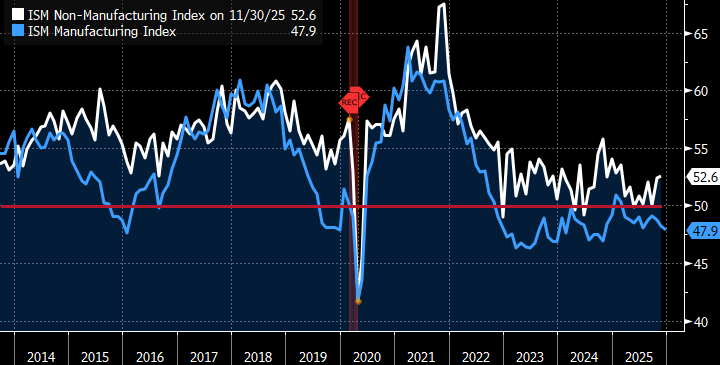

- A little later this morning, the December ISM Services Survey will be published. The ISM Manufacturing Index was released on Monday and was similar to what we’ve seen from the manufacturing sector for some time. It printed a reading of 47.9 vs. 48.4 expected and 48.2 in November. Prices paid remained elevated (58.5 v. 58.5) while new orders (47.7 vs. 47.4) and employment (44.9 vs. 44.0) were like November’s results, that is to say not so good.

- The ISM Services Index is expected to print 52.2 vs. 52.9 in November. Readings on employment, prices paid, and new orders will get attention prior to the jobs and inflation readings. While the manufacturing sector showed very little change from prior months, the services sector will once again be relied upon to keep the economic engine moving forward.

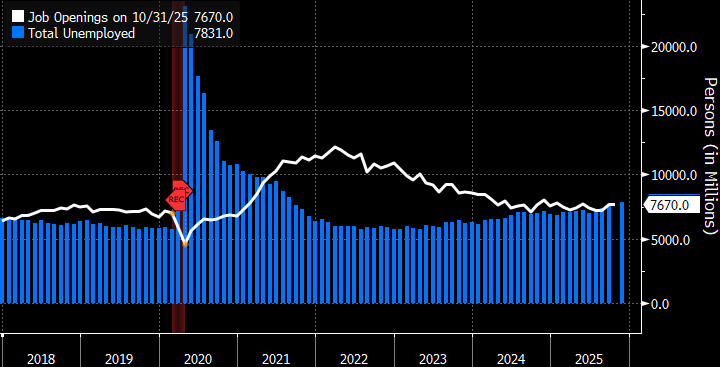

- Also, at 10am ET the November Job Openings and Labor Turnover Survey (JOLTS) will be released. This series has reported job openings declining in a steady fashion throughout 2025. The expectation for November is for openings to move a bit lower from 7.670 million to 7.600 million. Call the expected move inconsequential but another indication of a static labor market as 2025 came to an end. The Quits Rate (1.8% in Oct.) and Layoffs Rate (1.2% in Oct.) will get attention too, but again expectations are for nothing surprising to spring from this report other than a listless labor read.

- Fed Governor Stephen Miran was on Fox Business News yesterday with his well-known dovish view very much intact in the new year, saying the Fed needs to cut 100 bps this year. Recall, Miran has voted down every FOMC action he’s been involved with, preferring 50bps cuts vs. the 25bps cuts approved. He believes the current level (3.50% – 3.75%) remains well above neutral despite a consensus Fed view that the current funds rate is near neutral. Richmond Fed President, and non-voter, Tom Barkin took the consensus route that the current funds level is “within the range of its estimates of neutral.” On Monday, Minneapolis Fed President, and alternate voter, Neel Kashkari, said his guess was that “we’re pretty close to neutral right now” given resilient economic growth. The December dot plot had estimates of neutral ranging from 2.6% to 3.9% with a median of 3.0%.

ADP Private Payrolls Increase 41K in December

Source: ADP

Job Openings Expected to Continue Lower

Source: BLS

Tale of Two Sectors: ISM Manufacturing Mired Under 50 While ISM Services Staying Above

Source: ISM

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.