November Retail Sales Solid

- Cooler heads seem to be prevailing in the Powell/Subpoena dust up, and inflation seems to be cooling a bit too, according to the latest CPI release. We talk about that report in more detail below, along with a glance at the just released November Advance Retail Sales Report. The Supreme Court is set to issue more decisions at 10am ET. It’s not known whether the Trump tariff case will be part of today’s disclosure, but a negative ruling could be bond bearish as it implies a larger government deficit. Also, there is plenty of Fed speak on tap today, the Fed Beige Book, along with a plug for our latest podcast episode with Joe Keating. You’ll find the link to the recording below. Currently, the 10yr is yielding 4.16%, down 1bp, while the 2yr is yielding 3.52%, also down 1bp on the day.

- The brouhaha over the Powell subpoenas seems to be resolving quickly without significant market interruptions. With several Republicans coming to his defense, a letter of support signed by several former Fed chairs and Treasury secretaries, and a chorus of support from foreign central bank officials, the matter seems to be receding as quickly as it appeared. The DC area prosecutor, Jeanine Pirro, appears to have initiated the legal action without informing the President, or other senior members of the administration, making it easier to walk it back, and that looks to be happening. We expect Powell to stay on through May when his term as a chairman expires, and we wouldn’t be surprised to see him stay on as governor until that term expires in January 2028. Meanwhile, President Trump has said he still intends to name Powell’s successor within “the next few weeks.”

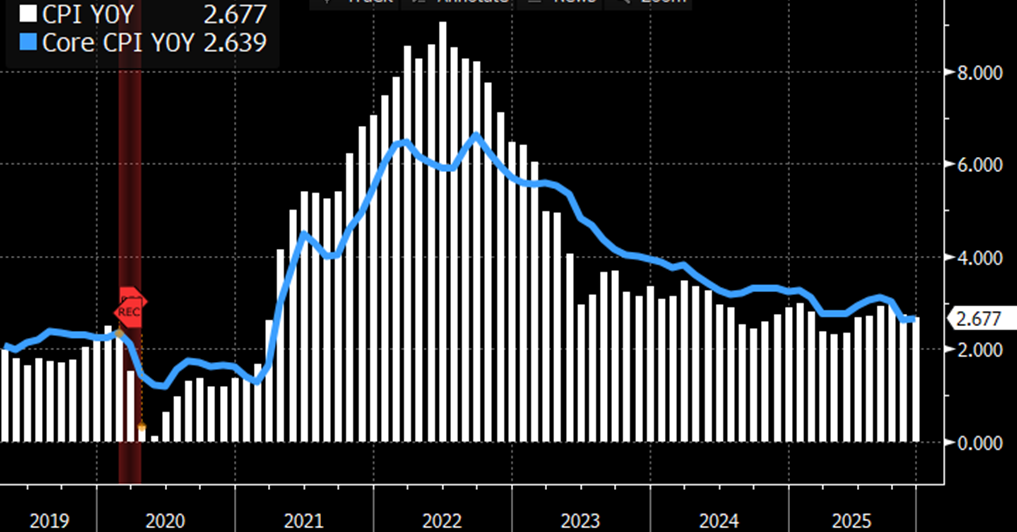

- Yesterday’s release of December CPI was mostly a routine affair, close to expectations with a slight downward tilt that has investors focusing now on the labor market for clues regarding the next Fed rate move. As expected, overall inflation increased 0.3% for the month with the YoY rate unchanged at 2.7%. Meanwhile, core CPI came in just below the 0.3% expectation at 0.24%, with the YoY rate unchanged at 2.6%, beating the 2.7% expectation. The biggest difference between overall and core CPI was food costs that rose 0.7% for the month, both at home and away from home. Food costs increased 3.1% for the year so the monthly jump was big and broad with price gains spread across 5 of 6 food categories.

- Shelter cost rose 0.4% as lodging expenses increased 2.9% for the month. Along with airfares that were up over 5% for the month it indicates the well-heeled consumer continued to spend on discretionary items, which bodes well for upcoming consumption figures. Meanwhile, Owners’ Equivalent Rent (OER) rose 0.3% but the issue there is the BLS decision coming out of the shutdown to roll forward pricing for 2 of the 6 geographic regions that didn’t get refreshed valuations in October and November. Thus, while the notoriously lagging OER finally started to roll downward last year, the process was slowed due to the lack of data collection during the shutdown. The regions that weren’t updated must wait until April and May when the next semi-annual pricing refresh for their regions are conducted.

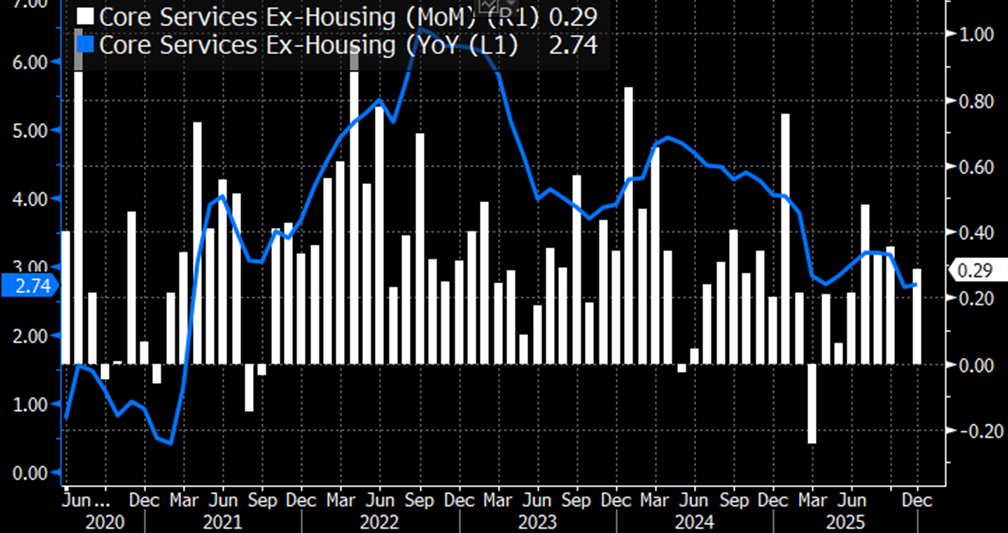

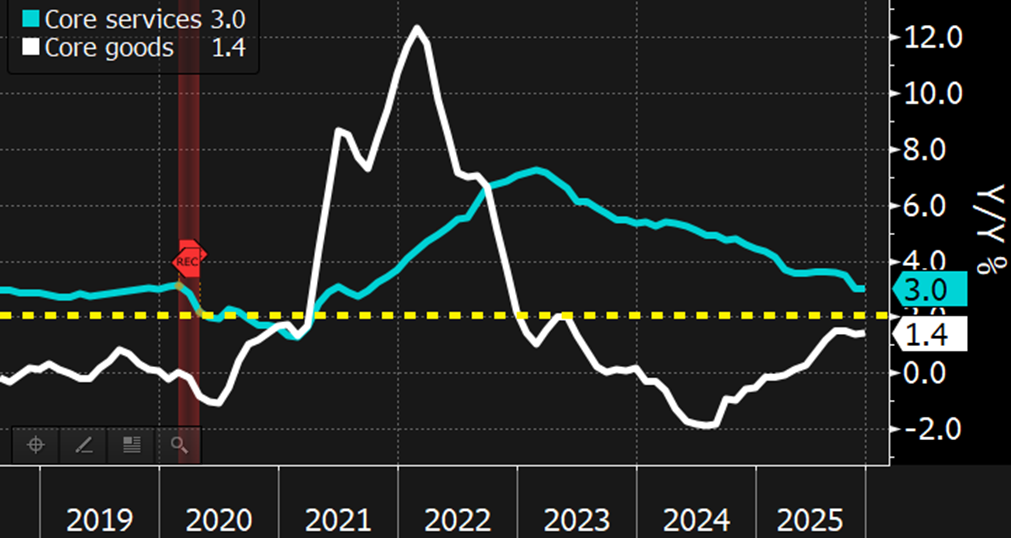

- Despite the slow resolution of the missing data, particularly OER, core service pricing remains well behaved – that was the so-called “sticky” inflation from the past couple years – and goods prices outside of women’s apparel fell during the month which is further proof that tariff pressures are abating. Thus, determining when the Fed will cut rates again is becoming more a function of the state of the labor market and less about prices as those are moderating with further improvement likely in the months ahead.

- This morning, we finally received the November Advance Retail Sales Report. Overall sales increased 0.6% vs. 0.4% expected and sales ex-autos and gas rose 0.4% vs. 0.3% expected. The so-called control group, a direct GDP feed, increased 0.4%, matching expectations and providing a nice boost to fourth quarter GDP. In summary, another solid showing by the US consumer, albeit a bit dated. The Census Bureau has yet to confirm a date for December retail sales but given the clues from December CPI regarding elevated prices on discretionary items like lodging and airfares we’re going to assume it was a decent to solid month, like November.

- We also received November PPI this morning but with December CPI already in hand, it’s a bit anti-climactic. Headline PPI rose 0.2% vs. 0.2% expected with the YoY rate at 2.7%, a level it’s been flirting with since August. PPI ex-food and energy increased 0.2% vs. 0.2% expected with the YoY rate beating 2.7% expectations at 3.0%. While the absence of data collection for October and the month-long delay in getting November PPI lessens the impact of the report, many PPI components feed into the Fed’s preferred inflation gauge, the Personal Consumption Expenditures (PCE), so filling in some of the data holes continues.

- There’s plenty of Fed speakers on the docket today with five FOMC officials scheduled to speak. However, NY Fed President John Williams spoke Monday night to the Council of Foreign Relations and offered a succinct outlook for this year that we generally agree with, “GDP growth looks to have been somewhat above 2 percent last year, and it will likely pick up some this year. Although the labor market cooled over the past couple of years, I expect that we’ll see it stabilize this year and then strengthen somewhat thereafter. Inflation appears likely to peak sometime in the first half of this year as the full effects of tariffs are felt and then will be poised to move back toward the FOMC’s 2 percent longer-run goal.”

- Last Friday, I had the chance to sit down with Joe Keating, Senior Portfolio Manager with SouthState Private Capital Management, and chat about the economy and outlook for this year in the latest episode of The Community Bank Podcast. While we recorded this before the Powell subpoena affair, Joe offered up plenty of thoughts regarding the Fed, the outlook for rates, the economy, and the stock market. Feel free to give it a listen, here.

CPI and Core CPI (YoY) Settling into mid 2% Range

Source: BLS

Core Services (Ex-Housing) Prices Continue to Moderate

Source: BLS

Both Core Goods and Services YOY Prices are Moderating

Source: BLS

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.