Ready for 2026? First, Get Ready for Some Data

- Welcome to 2026, and amazingly enough, to some fresh data that will be on display this week, headlined by the December jobs report on Friday. Before then the data starts to flow with today’s ISM Manufacturing Survey for December and a plethora of other reports that have been either missing or delayed since the government shutdown. The weekend events in Venezuela haven’t caused volatility in markets as of yet, but it does create more uncertainty around US foreign policy and the resulting economic implications. Currently, the 10yr Treasury is yielding 4.18%, down 1bp on the day, while the 2yr note yields 3.47%, also down 1bp in early trading.

- The deluge of data begins today culminating in a Friday jobs report, remember those? That will be the first since early September. Expectations are for job growth of 55 thousand (73 thousand private), and the unemployment rate dipping a tenth to 4.5%. Recall that November’s 4.6% result was from a close rounding call (4.564% unrounded), so don’t read too much into a dip, we’ll still be messing with those unrounded numbers, but suffice it to say that little is expected to change in the December jobs numbers from what we saw in November.

- Coming before the jobs release will be the pair of ISM surveys for December. The ISM Manufacturing Index will be released later this morning (10am ET), with a reading of 48.4 expected vs. 48.2 in November. The ISM Services Index will be released on Wednesday with a 52.2 headline expected vs. 52.9 in November. For both reports the readings on employment, prices paid, and new orders will all get some attention prior to the jobs and inflation readings. The expectations here, and with the jobs report, reflect a belief that little changed in December, at least on the labor front.

- Also, on Wednesday the November Job Openings and Labor Turnover Survey (JOLTS) will be released. Recall this series has seen job openings declining in a fairly steady fashion throughout 2025. The expectation for November is for openings to move a bit higher from 7.670 million to 7.726 million but call it inconsequential and yet another indication of a fairly static labor market as 2025 drew to a close. The Quits Rate (1.8% in Oct.) and Layoffs Rate (1.2% in Oct.) will get attention too, but again expectations are for nothing surprising to spring from this report.

- The latest read on the consumer will be released on Friday, after the jobs report, with the preliminary University of Michigan Sentiment Survey for January expected to show a headline sentiment at 53.4 vs. 52.9 in December. So, call it slight improvement following a slightly better read in December. Is the consumer starting to express a more optimistic outlook, or is it just really just another statistical push similar to the labor expectations? One thing that will be noted is the inflation expectations. The December Fed minutes noted some worry from the inflation-focused cohort that worried that inflation that tracks higher for longer will result in upward moves in inflation expectations. So far, those expectations have been pretty tame but a faction of the FOMC is definitely looking for possible shifts. Will this report deliver that?

- Fed speak will be light this week, at least the calendar says so, with just one on the schedule (Barkin tomorrow and again on Friday), but look for some unscheduled appearances from others who like to make their views known.

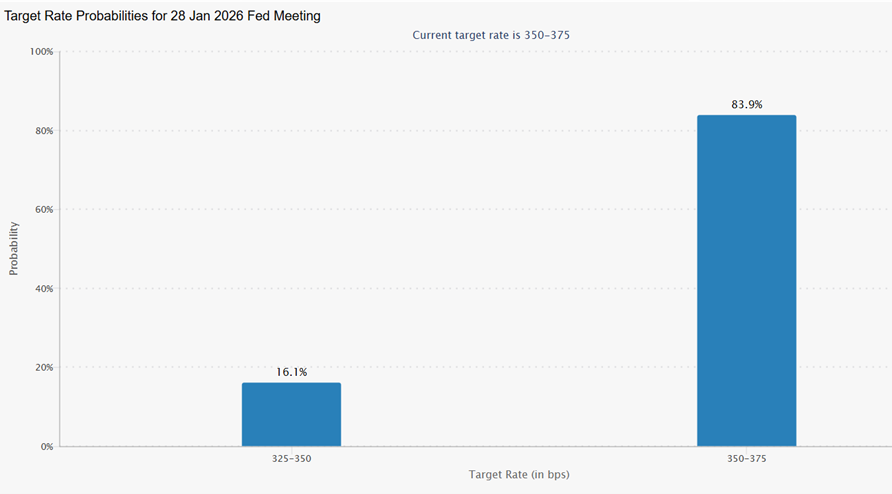

Odds for a January Cut Remain Quite Low

Source: CME Group

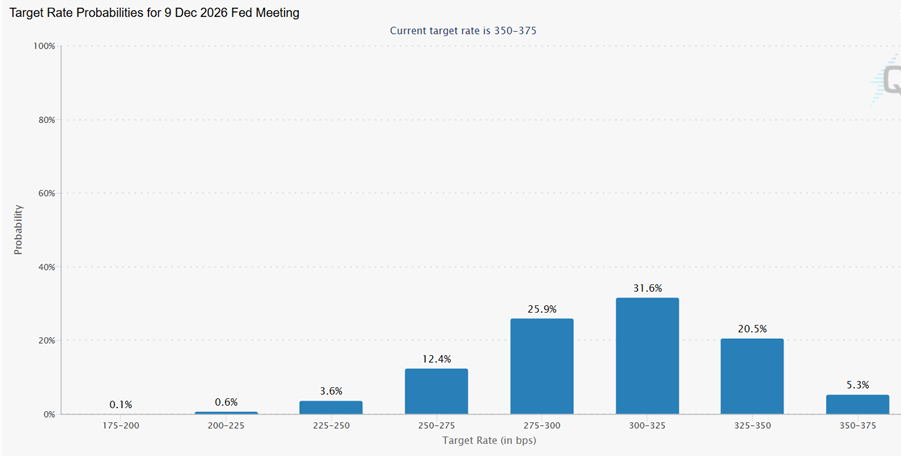

Meanwhile, December 2026 Odds Still See More Than 2 Cuts by Year End Source: CME Group

Source: CME Group

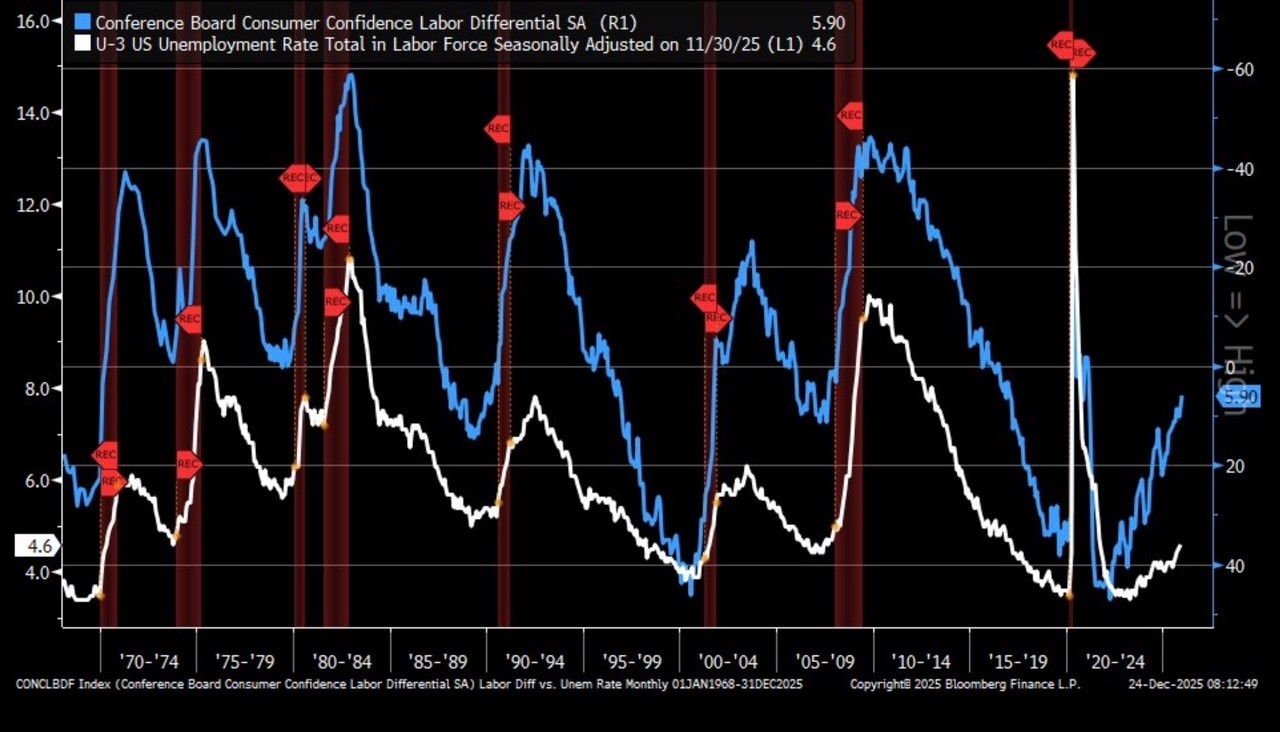

Conference Board’s Latest Labor Differential Points to Higher Unemployment

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.